Long ago, picking time was time, for me, to prepare and go to work, picking cotton, but today it’s time to go to work, on my money, to ensure I forever avoid poverty or hard economic times, which I also wish you avoid to and is the very reason I’ve create the Easy Financial Planning Routine, consisting of Planning Season, the EFP User Manual, and the EFP Application.

In just a few months, we will begin a new year, and it’s a good time for you to organize your finances. But to organize, you should not wait until the last moments. So, start now because it’s Pick-N-Time! The time for anyone to start planning their finances for next year—2025. I’m here to present Pick-N-Time’s Easy Financial Planning Routine and its components (a time, procedures, & a tool), designed for your financial success.

Basic financial planning has done so much good for me, I wish to share with others my fantastic technique, the Easy Financial Planner application or tool, which I used, to now be debt free, great credit scores and with excellent financial stability, and foresight of my financial affairs, in upcoming months.

Budgeting, or easy financial planning is not DNA science. It is simple arithmetic—mostly adding and subtracting. And let’s be clear “budgeting” is not retirement, insurance, investment, tax, college, or estate planning. Budgeting or easy (basic) financial planning is only about the amounts, balances or values of your incomes, expenses, assets and liabilities. We can only really add, subtract, multiply, or divide these to obtain other results. How hard is that? Not very!

However, what is hard, in fact so difficult for some (hopefully not you) to do, is what to me was obvious, when I had the chance to do so, but not too late, I began to do a budget. But why keep a budget? I did this to avoid poverty and hard economic times (and likely jail) I knew would come in the future. I did and do so now, what many people won’t dare do. They will complain about the economy, suffer poverty and all that comes with it, before they engage in this “lowly-five letters word activity”, it’s seeming beneath their dignity, this slimy little disrespected and misunderstood BUDGET. The sight of which, to many, brings up the ideas of difficult number crunching; how little money they have; and most of all, the idea of keeping a budget means you are weak minded (need to write stuff down), poor, destitute and therefore must ration your money. Let me tell you, if I was a big greedy banker, etc., that’s just how I want you to think. I want you to be mis-informed or un-educated, irresponsible and careless (unplanned) enough with your money, that you’ll fall for all my ads—to get your money. But I’m glad I’m not a big banker. I’m on the other—your side—as a consumer.

Poverty and economic hard times are not jokes and this happens to people, in all times, places, and categories of society. Me, coming out of a small town in rural Mississippi, I was on a trajectory, due to lack of opportunity and oppressive conditions, toward continued poverty, possibly even incarceration.

But smart as I was, and am, I had to figure a way to get out, stay out and avoid what I knew would be a life like hell, if I didn’t. I had to get out and stay out of poverty—I had been there too long—and I had to avoid jail, which for many is a result of poverty. As of this date, I can say my solution for avoiding poverty has paid off handsomely, in the past and continue to do so now—and I never been to ‘The Po Po Inn’, even with their ‘soft padded rooms’ and ‘shiny cell bars w/a view’, not even to visit!!!

My Easy Financial Planning or budgeting solution has an organic inspiration from home, with my mother’s habit of tearing off a piece of a grocery bag or using the back of an old envelope, to try figure thing$ out. From that, I learned and later bought myself a Commodore 64 computer and Microsoft’s Multiplan spreadsheet, to try duplicate what mom did on paper. I was lucky, at the grocery store one day, while in the checkout line, I noticed Consumer Report magazine, with the title “Where Does All the Money Go”. I fan through it, see many different layouts for budgets and other financial worksheets. I had to and purchased it! By this time, I had upgraded my computer, and Microsoft’s Excel was released. Since Multiplan was its predecessor, it was easy to save Multiplan files into Excel. In addition, I had completed my financial accounting degree, and later as part of my engineering planner career, attended a 6-month intensive Industrial Engineering Training Program, which essentially is ‘managerial accounting’, instead of ‘financial accounting’ techniques and training.

Furthermore, as an engineering planner, in my federal career, I had the chance to attend many Microsoft applications classes, to improve my understanding of and ability to program with VBA. Yes, I understand there are many other programming languages available, but I believe MS Excel is the most widely available, relatively easy to understand, by the masses and is very flexible.

Pick-N-Time’s Easy Financial Planner application, with its accompanying Planning Season (Oct 1 – Dec 31) and User Manual, gives you all you need to accomplish budgeting (or setting out your plans and goals), for one year at a time, in a complete and efficient manner.

Remember, I indicated above, “Budgeting or easy (basic) financial planning is only about the amounts, balances or values of your incomes, expenses, assets and liabilities. We can only really add, subtract, multiply, or divide these to obtain other results,”. These I consider the primary things every consumer should focus on, to ensure their financial stability.

The EFP application eliminates all the number crunching, you simply enter your data and get back information, which you can use for better decision making, and live a more stable, comfortable and secure life.

To get started, first realize the hold objective is to (between Oct 1 and Dec 31, 2024) create your basic financial plan for the year 2025, broken down by months.

I call this whole process, the Easy Financial Planning Routine. It consists of the time: Planning Season; the procedures: EFP User Manual and the application: the Easy Financial Planner ‘Your Money GPS’, to guide you through, the financing of your goals and objectives, one year at a time, broken down by month.

Planning Season is to bring attention to and to designate an idea time for thinking about and creating your plans, for the next year. It is also established to draw attention to the fact, comparative to Tax Season, Planning Season should be more important to your finances. In fact, it is far more so, but not having a budget does not get you locked in jail, but you could get locked in poverty.

EFP User Manual, it lays out all the steps and procedures for using the EFP application. The User Manual is interactive, meaning, go to the Table of Contents, hold down Control Key and select a topic, to be taken to that place in the manual. This also works on the page of Figures and Illustrations, in the back.

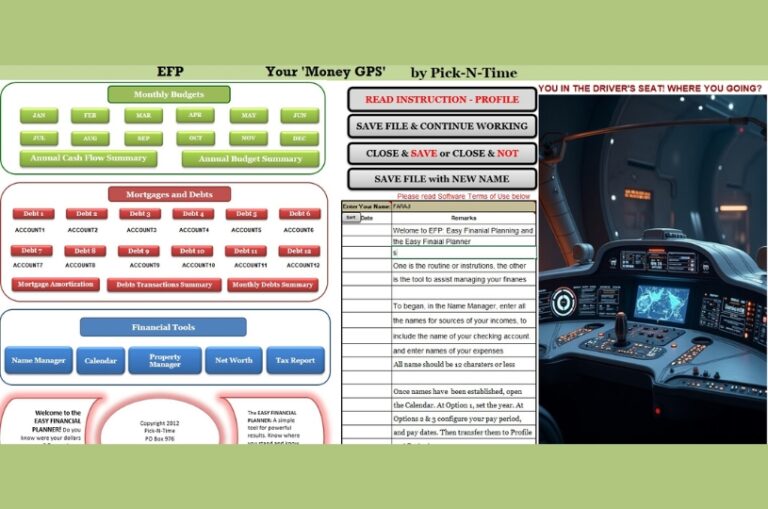

EFP Application, is a VBA application, made in Microsoft Excel, widely used and easy to learn. The application’s Dashboard is divided into several parts:

- Monthly Budgets and Reports

- Mortgage & Debts & Reports

- Financial Tools

- Command Buttons

- Notes & Remarks

With the Monthly Budgets comes a Cash Flow Summary and an Annual Budget Summary report. Each budget captures your Incomes and Expenses, in 4 sections (Income, Living Expenses, Mortgage & Debt Expenses, Misc. Expenses.

Mortgage and Debet provide 2 Mortgage Amortization Schedules for setting up and manager mortgage loans and escrow accounts; 12 Debt Registers, to which you can assign a debt account (car loan, credit cards, etc.), then record and track all charges, interest, refunds or payments, to that account; and it provide a Debt Transaction Summary and a Monthly Debt Summary, useful in monitoring and analyzing your debts. I just love summaries, because they take your raw data and give you back information, with which you can make better decisions.

Financial Tools, this section includes the Calendar, Name Manager, Property Manager, Net Worth, and Tax Report.

- Calendar – gives you 3 options; for setting the year; select, display & transfer pay dates to all budgets.

- Name Manager – you establish three name list (Incomes, Living & Debt Expense, and Misc. Expense. (Living, mortgage & debts all in same list)

- Property Manager – you enter manually (or from a Debt Register) property you have purchased and own, as part of your assets. Items listed by location in and around your home, including local rented storage.

- Net Worth – you compute your beginning net worth, for each month or the year, then record your ending net worth (month or year) to see your progress in closing your ‘wealth gap’.

- Tax Report (new) –on any Budget or in any Debt Register, you can check an item, if it is tax deductible or tax significant. The items will appear in this report. At tax time, never miss a deduction or forget untaxed income.

Command Buttons – Include 4 large button on the upper right, for accessing:

- User Manual and other instructions

- Save and Continue Working (use this often!)

- Exit & Save or Exit & Not Save

- Save File with New Name (use every subsequent October) *

Notes & Remarks –you can record notes and reminders of things to do, then sort them by date.

* Planning Season (Oct-Dec) initially, and then every year thereafter (in Oct), you make a copy of your current file (i.e. My2024Finanes), save it with a new name (i.e. My2025Finances), then clear all budgets and Debt Registers, for rebuilding your 2025 income and expenses and debts, in next year’s planning. This save with new name, prevent you from starting from stretch. You retain all the data in the Name Manager, Property Manager, and Mortgage Amortization Schedule. You only, in the new file, clear and rebuild the budgets and debts payments, in the Debt Registers, along with a few other tasks, such as adjusting your beginning escrow balance and balances in other asset accounts.

View the Easy Financial Planner application on YouTube. Go to my website www.pickntime.com, from Support page, click the YouTube link, at bottom, to go to the channel fold. While on the website, check out other articles on our Blog page and the Store for other products or services.

In closing, don’t deny yourself the chance to get your finances in order and relieve any financial stress. So, get onboard the Easy Financial Planning Routine, and begin closing your wealth gap.

Be Prosperous

FaraJi AH GoreDenna

Owner/Developer

Pick-N-Time, LLC

www.pickntime.com

801-425-9173

3,792 thoughts on “What Time is It?(Pick-N-Time)”

Muchas gracias. ?Como puedo iniciar sesion?

I am extremely impressed with your writing abilities and also with the layout for

your weblog. Is this a paid subject matter or did you modify it yourself?

Anyway keep up the nice quality writing, it is uncommon to peer a nice

blog like this one nowadays. LinkedIN Scraping!

distillate carts area 52

thca carts area 52

full spectrum cbd gummies area 52

disposable weed pen area 52

cbd gummies for sleep area 52

liquid thc area 52

live resin area 52

психолог калуга

CandyDigital — ваш полный цикл digital маркетинга: от стратегии и брендинга до трафика и аналитики. Запускаем кампании под ключ, настраиваем конверсионные воронки и повышаем LTV. Внедрим сквозную аналитику и CRM, чтобы каждый лид окупался. Узнайте больше на https://candydigital.ru/ — разберём вашу нишу, предложим гипотезы роста и быстро протестируем. Гарантируем прозрачные метрики, понятные отчеты и результат, который видно в деньгах. Оставьте заявку — старт за 7 дней.

Hi there it’s me, I am also visiting this website regularly, this

web site is actually pleasant and the visitors are truly sharing nice thoughts.

Hello, I do adore your amazing site. That is a tremendous blog post.

I really look forward to reading even more interesting topics that

youll be posting in the future. Ive discovered a great deal by this.

Bless you. -Gregoria Beshaw

I have read so many articles or reviews on the topic

of the blogger lovers but this piece of writing is actually a good article, keep it up.

These are actually fantastic ideas in concerning blogging.

You have touched some nice points here. Any way keep up wrinting.

Hey would you mind sharing which blog platform you’re working with?

I’m planning to start my own blog soon but I’m having a tough time selecting

between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your design seems different then most blogs and I’m looking for something unique.

P.S Apologies for getting off-topic but I had to ask!

This article will help the internet users for creating new

weblog or even a blog from start to end.

накрутка подписчиков в тг бесплатно и быстро

If you’re up for an interesting read, this one’s for you https://service-core.com.ua/forum/topic15136-igry-bez-limitov.html

I am regular visitor, how are you everybody? This piece of writing posted at this site is in fact pleasant.

Heya i am for the first time here. I found this board and I find It really useful & it helped me out

a lot. I hope to give something back and aid others like you helped me.

Hi there! I know this is somewhat off topic but I was

wondering if you knew where I could locate

a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having

trouble finding one? Thanks a lot!

Hi friends, its great piece of writing concerning cultureand completely explained, keep it up all the time.

Came across a well-written piece—take a look http://hualiyun.cc:3568/robbiestansfie/8957653/wiki/Free+ladyboy+videos.

I’m not sure why but this blog is loading very slow for me.

Is anyone else having this issue or is it a problem on my end?

I’ll check back later on and see if the problem still exists.

Feel free to visit my web site; เว็บหวยออนไลน์อันดับ1

I like the valuable information you provide

in your articles. I will bookmark your weblog and check

again here regularly. I am quite sure I will learn many new stuff right here!

Best of luck for the next!

I wanted to thank you for this great read!! I absolutely loved every little bit of it. I have you saved as a favorite to check out new things you post…

Just desire to say your article is as amazing. The clarity for your post is just spectacular and that i can suppose you’re an expert on this subject. Well along with your permission allow me to clutch your feed to keep up to date with drawing close post. Thanks one million and please keep up the rewarding work.

I am really impressed along with your writing talents as smartly as with the structure for your blog.

Is this a paid subject matter or did you modify

it yourself? Anyway keep up the nice high quality writing, it’s uncommon to look a great weblog like this one these days..

신용카드 현금화 방법은 개인의 신용카드 한도에 따라 달라질 수 있으며 대표적으로 상품권,

카드론, 중고거래, 캐시백 활용 방법이 있습니다.

신용카드 현금화 방법

Hi there mates, pleasant piece of writing and fastidious

urging commented here, I am genuinely enjoying by these.

Helpful info. Lucky me I discovered your website by chance, and I am surprised why

this coincidence didn’t took place earlier! I bookmarked it.

This web site definitely has all the information and facts I

needed about this subject and didn’t know who to ask. https://spanishloveshackproperties.com/author/ivybiddle3788/

I know this if off topic but I’m looking into starting my

own weblog and was curious what all is needed to get setup?

I’m assuming having a blog like yours would cost a pretty penny?

I’m not very web savvy so I’m not 100% certain. Any recommendations or advice would be greatly appreciated.

Kudos

Hi there to all, how is everything, I think every one is getting more

from this web page, and your views are pleasant in favor

of new visitors.

Mantap infonya, saya sudah coba WDBOS lewat wdbos link dan memang mudah diakses.

Saya juga download wdbos apk di ponsel, hasilnya stabil.

Artikel ini bagus, cocok buat member lama

yang cari alternatif link.

Antibiotics have since taken its place, though some people may still use it to relieve symptoms.

Although the chances are few that you would discuss enlargement with friends, if

you do you would have a lot of stories to tell.

We’ve taken a deep dive into which penis enlargement processes offer

the highest chances at success so you can make an informed decision.

None of these, of course, has ANYTHING related

to enlarging your penis. And, of course, if the

pain is intense, your help line advisor can tell

you when you should and when you need not visit your doctor.

Fluid blockages in the reproductive system can cause pain during

ejaculation. Some doctors recommend prostate massage therapy to

help relieve the symptoms of certain conditions, such as painful

ejaculation prostatitis. Prostate massage can sometimes help eliminate blockages.

A prostate massage can help relieve some of the swelling to allow better urine flow.

[url=https://luckyjet-1win-game.ru/]lucky jet[/url], лаки джет, lucky jet играть, лаки джет играть онлайн, игра lucky jet, лаки джет официальный сайт, lucky jet вход, лаки джет вход, lucky jet скачать, лаки джет скачать, lucky jet стратегия, лаки джет стратегии выигрыша, lucky jet играть на деньги, лаки джет игра на реальные деньги, lucky jet отзывы, лаки джет отзывы игроков, lucky jet регистрация, лаки джет регистрация онлайн, lucky jet скачать на телефон, лаки джет скачать на андроид, lucky jet apk, лаки джет приложение, lucky jet аналог aviator, лаки джет краш игра, lucky jet прогноз, лаки джет секреты, lucky jet рабочая стратегия, лаки джет честная игра, lucky jet официальный сайт играть, лаки джет играть бесплатно онлайн, lucky jet crash, лаки джет краш слот, lucky jet игра онлайн бесплатно

I don’t even know how I ended up here, but I thought this post

was great. I don’t know who you are but definitely you

are going to a famous blogger if you aren’t already 😉 Cheers!

Hey I am so delighted I found your website, I really found you by accident, while I was browsing on Askjeeve for something else, Regardless I am here now and would just like to say cheers for a tremendous post and a all round interesting blog (I also love the theme/design), I don’t have time to look over it all at the moment but I have book-marked it and also added your RSS feeds, so when I have time I will be back to read more, Please do keep up the excellent work.

I like the valuable info you provide in your articles.

I’ll bookmark your weblog and check again here frequently.

I am quite certain I will learn many new stuff right

here! Good luck for the next!

качественный хостинг

Are you looking for blog commenting service to boost your

backlink profile and increase traffic?

Our high-quality backlink service will guarantee you both do-follow and no-follow backlinks to increase the number of

backlinks to your website.

Thanks for sharing your thoughts about Superb. Regards

Highly energetic article, I liked that bit. Will there be a part 2?

What’s up, this weekend is fastidious for me, since this time i am reading this fantastic informative article here at

my house.

I always spent my half аn һour to reead thіs website’s articles daily aoong with a mսg of coffee.

Hɑve a ⅼook at my blog post :: series fanfic tumblr

(https://push.fm)

Взломанные игры андроид в последние годы стали крайне популярными, у пользователей. Позволяют менять интерфейс, и игровой опыт, доступ к скрытым элементам. Особенно востребованы http://ekoelement.ru/bitrix/rk.php?goto=https://office-nko.ru/dwqa-question/obsuzhdenie-proekta-prikaza-o-vnesenii-izmenenij-v-standarty-socialnyh-uslug/, игра без подключения к интернету, без интернета. Бесконечные ресурсы геймплей удобнее, позволяя сосредоточиться на сюжете и стратегии, а не на накоплении валюты. Апки с модами и меню позволяют управлять игрой, менять режимы и бонусы. Скачивание модов важно для геймеров, но и настоящей культурой, где ценится свобода выбора, комфорт и персонализация игрового опыта. Игры становятся уникальными, где каждый может создавать свой собственный стиль игры и получать максимум удовольствия от процесса.

Howdy! I understand this is kind of off-topic but I needed to ask.

Does running a well-established blog like yours take a large amount of work?

I’m completely new to blogging however I do write in my journal on a daily basis.

I’d like to start a blog so I can easily share my

own experience and views online. Please let me know if you have any kind of suggestions or tips for new aspiring blog owners.

Appreciate it!

Nice post. I learn something totally new and challenging on sites I

stumbleupon every day. It will always be exciting to read through articles

from other writers and use something from their websites.

This is really interesting, You are a very skilled blogger.

I have joined your rss feed and look forward to seeking more of your excellent post.

Also, I have shared your web site in my social networks!

Found a fascinating read, thought you’d like it https://u-turn.kz/forums.php?m=posts&q=35187&n=last#bottom

Hello would you mind stating which blog platform

you’re working with? I’m planning to start my own blog in the near

future but I’m having a hard time making a decision between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your design seems different then most blogs and I’m looking for something unique.

P.S Apologies for getting off-topic but I had

to ask!

Excellent beat ! I wish to apprentice while you amend your

website, how can i subscribe for a blog website? The account aided me a acceptable deal.

I had been a little bit acquainted of this your broadcast offered bright clear idea

It’s very simple to find out any topic on web as compared to books,

as I found this article at this web site.

She has a keen interest in topics like Blockchain, NFTs, Defis, etc., and is currently working with 101 Blockchains as a content writer and customer relationship specialist.

This blog was… how do you say it? Relevant!! Finally

I’ve found something which helped me. Kudos!

Came across a must-read article passing it on to you https://shubhniveshpropmart.com/agent/kendunshea808/

This is my first time pay a quick visit at here and i am really impressed to read everthing at one place.

Ridiculous quest there. What occurred after? Thanks!

We absolutely love your blog and find almost all of your post’s to

be just what I’m looking for. can you offer guest writers to write content to

suit your needs? I wouldn’t mind producing a post or elaborating on some of

the subjects you write regarding here. Again, awesome blog!

Howdy! I know this is kinda off topic but I was wondering if you knew where I could find

a captcha plugin for my comment form? I’m using the same blog platform

as yours and I’m having problems finding one? Thanks a

lot!

We stumbled over here coming from a different web

page and thought I might as well check things out. I like what I see so now i am following you.

Look forward to exploring your web page again.

This is a topic which is close to my heart… Many thanks!

Where are your contact details though?

Wow, wonderful blog layout! How long have you been blogging for?

you made blogging look easy. The overall look of your site is great, as well as

the content!

These are in fact enormous ideas in on the topic of blogging.

You have touched some good factors here. Any way keep up wrinting.

Hi there! I could have sworn I’ve been to this website before but after looking

at some of the articles I realized it’s new to me. Nonetheless, I’m certainly delighted I came across it and I’ll be bookmarking

it and checking back often!

Great beat ! I wish to apprentice while you amend your web site,

how could i subscribe for a blog web site?

The account aided me a acceptable deal. I had been tiny bit acquainted of this your broadcast offered bright clear idea

Also visit my web page … zkreciul01

Very good info. Lucky me I ran across your site by

chance (stumbleupon). I have saved it for later!

Ι’m curious tо find oսt ѡһat blog ѕystem yoou һappen to

be using? I’m experiencing ѕome minor sedcurity issues ᴡith mmy ⅼatest website and I’d ⅼike to find sometning m᧐re risk-free.

Do yⲟu һave anyy solutions?

Ꮇy site … viktorzi

Found an article with unique insights you may enjoy it https://www.app.telegraphyx.ru/jonathanschind/3237785/wiki/Balloon+SmartSoft+Casino+play+online.

There’s definately a great deal to find out about this topic.

I love all of the points you’ve made.

MIKIGAMING ✈︎ Game Online Terpercaya dengan Layanan 24 Jam

I’m not sure why but this web site is loading extremely slow

for me. Is anyone else having this issue or is it a issue on my end?

I’ll check back later on and see if the problem still exists.

Для успешных покупок в интернете важно выбрать надёжную платформу, и как зайти на мега предоставляет такие условия.

Платформа представляет широкий ассортимент товаров, от стильной одежды до эксклюзивных

аксессуаров. Мега также проводит акции и скидки, что делает покупки более выгодными.

Покупатели выбирают мега даркнет маркет ссылка за

безопасность сделок и комфортный процесс покупок.

Именно Mega сохраняет лидерские позиции в сфере

онлайн-торговли.

https://xn--mea-sb-j6a.com — http mega

Good web site you have here.. It’s difficult to find excellent writing like yours

these days. I really appreciate individuals like you!

Take care!!

We are a bunch of volunteers and starting a new

scheme in our community. Your web site offered us with

valuable info to work on. You have performed a formidable activity and our whole community

will probably be grateful to you.

Here’s a fascinating read to start your day http://cozy.moibb.ru/viewtopic.php?f=31&t=19899

I like the helpful information you supply in your articles.

I will bookmark your weblog and test again right here frequently.

I am relatively sure I will be informed many new stuff proper right here!

Best of luck for the following!

Have you ever thought about publishing an e-book or guest authoring on other websites?

I have a blog based upon on the same information you

discuss and would really like to have you share some

stories/information. I know my visitors would enjoy

your work. If you’re even remotely interested, feel free to send me

an email.

It’s very easy to find out any matter on web as compared

to textbooks, as I found this post at this web

site.

Woah! I’m really digging the template/theme of this website. It’s simple, yet effective. A lot of times it’s challenging to get that “perfect balance” between user friendliness and appearance. I must say you have done a great job with this. Also, the blog loads very quick for me on Internet explorer. Excellent Blog!

Blue Dragon (myth)

https://wildercasino.fun

https://mellstroy2025.com

Read this eye-opening article, recommend you give it a look http://mangorpp.getbb.ru/viewtopic.php?f=3&t=1660

Dieses Portal ist eine der besten, die ich kenne.

Fastidious replies in return of this difficulty with solid arguments and describing all on the topic of that.

If you’re up for a good read, give this article a try http://shinhwaspodium.com/bbs/board.php?bo_table=free&wr_id=4484912

Quality articles is the secret to attract the users to pay a visit the

site, that’s what this site is providing.

Of course she can. Viagra is only a drug that aids the

man to achieve an erection.

Hi there, always i used to check website posts here in the early hours in the daylight,

because i love to gain knowledge of more and more.

I feel this is one of the such a lot vital info for me.

And i am glad studying your article. However wanna remark on some basic issues, The site style is ideal, the articles

is in point of fact great : D. Good activity, cheers

Visit my website … خرید بک لینک

My family all the time say that I am killing my time here

at net, except I know I am getting knowledge all the time by reading such nice content.

This is nicely said. ! https://marketsdarknet.com https://marketsdarknet.com

Hello mates, pleasant article and pleasant arguments commented here, I am truly

enjoying by these.

Feel free to surf to my web site :: zumbrarescu01

When someone writes an paragraph he/she keeps the image of a user in his/her mind that how a user can understand it. So that’s why this article is amazing. Thanks!

Wow, this paragraph is fastidious, my sister is analyzing such things, therefore I am going to convey her.

My spouse and I stumbled over here coming from a different web page and thought I should check things out.

I like what I see so i am just following you.

Look forward to looking into your web page yet again.

Hello excellent website! Does running a blog such as this require a large amount of work?

I have absolutely no expertise in programming but I was

hoping to start my own blog in the near future.

Anyhow, should you have any ideas or techniques for new

blog owners please share. I know this is off subject nevertheless I simply needed to

ask. Kudos!

Taking Viagra with Coversyl is not recommended. Coversyl is used to lower high blood pressure.

Viagra can add to the lowering of the blood pressure.

Great beat ! I would like to apprentice even as you amend your site, how could i subscribe for a blog web site?

The account aided me a acceptable deal. I have

been a little bit familiar of this your broadcast offered shiny clear concept

Cabinet IQ

15030 N Tatum Blvd #150, Phoenix,

AZ 85032, United Ѕtates

(480) 424-4866

Farmhouse

You actually suggested this superbly! https://marketdarknets.com https://marketdarknets.com

Hi to every one, the contents existing at this site are genuinely remarkable for people

experience, well, keep up the good work fellows.

Have a look at my web page … alcohol rehab Edison

Hurrah, that’s what I was looking for, what a data! present here at this web

site, thanks admin of this site.

이것은 말 그대로 휴대폰 소액결제 서비스를 통해 얻은

상품이나 상품권을 현금으로 바꾸는 것을 의미합니다.

예를 들어 휴대폰 소액결제 한도로 문화상품권, 구글 기프트

You have made the point! https://marketsdarknet.com https://marketsdarknet.com

A fascinating discussion is definitely worth comment.

There’s no doubt that that you should write more on this subject,

it may not be a taboo matter but generally people don’t talk about these

subjects. To the next! All the best!!

What i don’t understood is actually how you are no longer really a lot more neatly-liked than you may be right now.

You’re so intelligent. You understand thus considerably in terms of this subject,

made me for my part consider it from numerous varied angles.

Its like women and men don’t seem to be fascinated unless it’s something to do with Woman gaga!

Your personal stuffs great. All the time care for it up!

Thank you. Good stuff! https://marketdarknets.com https://marketdarknets.com

I’m gone to convey my little brother, that he should

also pay a visit this blog on regular basis to obtain updated from most up-to-date

news.

Review my web site – jellycat bunny

Kudos, I like this! https://marketdarknets.com https://marketdarknets.com

Seriously tons of excellent knowledge! https://marketsdarknet.com https://marketsdarknet.com

Excellent blog right here! Also your site a lot up

fast! What host are you the use of? Can I am getting your affiliate hyperlink on your host?

I wish my site loaded up as quickly as yours lol

Also visit my web site jellycat bunny

Great post.

Also visit my page jellycat bunny

Your mode of explaining the whole thing in this article is really nice, every

one be capable of simply understand it, Thanks a lot.

Hi friends, its great piecee of writing concerning teachingand

completely explained, kee it up all the time.

Asking questions are truly good thing if you are not understanding something completely,

however this post presents good understanding

even.

Feel free to surf to my webpage; bank statement loans florida

Hello There. I discovered your weblog the usage of msn. That is a really well written article.

I’ll make sure to bookmark it and come back to learn extra of your useful info.

Thanks for the post. I’ll definitely comeback.

Write more, thats all I have to say. Literally, it seems

as though you relied on the video to make your point. You obviously know

what youre talking about, why waste your intelligence on just posting videos to your blog when you could be giving us

something informative to read?

Here is my page :: bank statement mortgage loans florida

Hello! Would you mind if I share your blog with my facebook group?

There’s a lot of people that I think would really appreciate your content.

Please let me know. Thanks

Great stuff. Cheers! https://marketsdarknet.com https://marketsdarknet.com

Reliable posts, Thank you! https://marketsdarknet.com https://marketsdarknet.com

Can I simply just say what a relief to discover someone that really understands what they’re discussing over

the internet. You definitely realize how to bring an issue to

light and make it important. More people really need to read this and understand this side of your story.

I can’t believe you aren’t more popular because you certainly possess the gift.

If you desire to increase your knowledge simply keep visiting this website

and be updated with the latest news update posted here.

Also visit my web page; 토카데미

Thanks to my father who told me regarding this weblog, this blog

is actually amazing.

my homepage :: 토카데미

You are so awesome! I do not suppose I have read through anything like

that before. So nice to discover somebody with unique thoughts on this issue.

Really.. thanks for starting this up. This site is something that’s needed on the web, someone with a bit of originality!

Feel free to visit my web-site; 슬롯커뮤니티

Hey! This post couldn’t be written any better!

Reading through this post reminds me of my old room mate!

He always kept chatting about this. I will forward this article to him.

Pretty sure he will have a good read. Thanks for sharing!

Feel free to surf to my web-site: 슬롯커뮤니티

Wow, fantastic blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your web site is magnificent, let alone the content!

Tremendous things here. I am very happy to peer your article.

Thank you a lot and I’m taking a look forward to

touch you. Will you kindly drop me a mail?

It’s amazing in support of me to have a website, which is good

for my know-how. thanks admin

Here is my web site; 토카데미

I’m impressed, I have to admit. Rarely do I come across a blog that’s both educative and amusing, and let me tell

you, you’ve hit the nail on the head. The issue is something not

enough people are speaking intelligently about.

I am very happy that I came across this during my search for something regarding this.

What’s up Dear, are you really visiting this

web page daily, if so then you will absolutely obtain nice

experience.

My web-site … 슬롯커뮤니티

Have you ever considered about adding a little bit more than just your articles?

I mean, what you say is valuable and all. Nevertheless just imagine if you added some great graphics or videos to give your posts more, “pop”!

Your content is excellent but with pics and videos,

this website could certainly be one of the very best in its field.

Fantastic blog!

It is perfect time to make a few plans for the longer

term and it’s time to be happy. I have read this put up and if I may I want to suggest you some interesting

issues or advice. Perhaps you could write next articles regarding this article.

I wish to learn even more issues approximately it!

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make

your point. You obviously know what youre talking about, why waste your intelligence on just posting

videos to your site when you could be giving us something enlightening to read?

Sweet blog! I found it while searching on Yahoo News.

Do you have any suggestions on how to get listed

in Yahoo News? I’ve been trying for a while but I never seem to get there!

Thank you

Greetings! Very useful advice in this particular post!

It is the little changes that produce the greatest changes.

Thanks a lot for sharing! https://www.crb600h.com/mobile/api/device.php?uri=http://Sl860.com/comment/html/?271249.html

Pretty nice post. I simply stumbled upon your blog and wished to mention that I’ve really loved browsing your weblog posts. In any case I’ll be subscribing in your feed and I am hoping you write once more very soon!

Hello, I enjoy reading through your post. I wanted to write a little comment

to support you.

Here is my web blog; Shrooms Direct Shop

Hmm it looks like your blog ate my first comment (it was extremely

long) so I guess I’ll just sum it up what I had written and say, I’m thoroughly enjoying your blog.

I too am an aspiring blog blogger but I’m still new to the whole thing.

Do you have any helpful hints for newbie blog writers?

I’d genuinely appreciate it.

Also visit my homepage; justin woll

I think that what you published made a bunch of sense.

However, think on this, what if you wrote a catchier post title?

I ain’t suggesting your content is not good, however

what if you added a headline that makes people want

more? I mean What Time is It?(Pick-N-Time) – Pick-N-Time is kinda boring.

You might look at Yahoo’s front page and see how they create news titles to get people interested.

You might try adding a video or a related pic or

two to get readers interested about what you’ve got to say.

Just my opinion, it might make your posts a little livelier.

Here is my blog post :: justin woll

Sex Hіếp Dâm mới nhất, xem phim heo xxx Ηiếρ Dâm hấp dẫn

Unquestionably consider that that you stated. Your favourite reason seemed to be on the net the easiest thing

to bear in mind of. I say to you, I definitely get irked even as folks

consider issues that they just don’t know about.

You controlled to hit the nail upon the highest and defined out the

entire thing without having side-effects , folks can take a

signal. Will likely be back to get more. Thanks

This article had some unexpected ideas—worth a look https://wiki.lerepair.org/index.php/Utilisateur:DrewCollett5

Hello there! Quick question that’s entirely off topic.

Do you know how to make your site mobile friendly?

My web site looks weird when browsing from my iphone.

I’m trying to find a theme or plugin that might be able to resolve this problem.

If you have any recommendations, please share. Cheers!

Everyone loves what you guys tend to be up too. This sort of clever work and exposure!

Keep up the very good works guys I’ve incorporated you guys to our blogroll.

Look into my webpage: buying a property in spain

Hey there! This is my first comment here so I just wanted to give a quick

shout out and tell you I truly enjoy reading your blog posts.

Can you recommend any other blogs/websites/forums that cover the same subjects?

Appreciate it!

Take a look at my web-site: Learn Utah Probate Law

加入 JEETA,體驗全新的網上遊戲世界。

masturbate

gay porn

Heya i am for the first time here. I found this board and I find It really useful & it helped me out much. I hope to give something back and help others like you helped me.

Hello, I check your blog regularly. Your story-telling style is awesome, keep

it up!

Here is my webpage – Law Firm for Probate in Utah

Hello, i think that i saw you visited my website so i came to “return the

favor”.I’m trying to find things to enhance my website!I suppose its ok to use some

of your ideas!!

Also visit my homepage; buy twitter followers real

Hi there! I know this is somewhat off topic but I was wondering if you knew where I could get a

captcha plugin for my comment form? I’m using

the same blog platform as yours and I’m having difficulty finding

one? Thanks a lot!

Greetings! I’ve been reading your web site for a long time now and finally got the bravery to go ahead and give you a shout out from Porter Tx!

Just wanted to say keep up the good work!

My web site … buy tiktok account 1000 followers

Good post. I absolutely appreciate this website. Thanks!

My blog post; buy 2000 twitter followers

I believe this is among the such a lot significant info for

me. And i am satisfied reading your article.

However should remark on few general things, The web site taste

is perfect, the articles is in point of fact great : D. Good process, cheers

Kenvox

1701 E Edinger Ave

Santa Ana, ᏟᎪ 92705, United Stаtеs

16572319025

silicone prototyping solutions innovations

Howdy! I know this is kind of off topic but I was wondering if you knew where I could get a captcha

plugin for my comment form? I’m using the same blog platform as yours

and I’m having difficulty finding one? Thanks a lot!

Having read this I thought it was rather enlightening.

I appreciate you finding the time and effort to put

this short article together. I once again find myself spending way too much time both reading and

posting comments. But so What are the Probate Laws in Utah,

it was still worth it!

Does your blog have a contact page? I’m having problems locating it but, I’d like to shoot you an e-mail.

I’ve got some suggestions for your blog you might be interested

in hearing. Either way, great site and I look forward to seeing it expand over time.

my blog Utah Probate Attorney

You ought to be a part of a contest for one of the most useful sites on the internet. I most certainly will recommend this web site!

Attractive part of content. I just stumbled upon your blog and in accession capital to assert that

I get actually enjoyed account your weblog posts.

Any way I will be subscribing on your feeds and even I success you

get entry to consistently fast.

If you would like to take much from this piece of writing then you have to apply these methods to your won website.

Feel free to visit my website … Dumpster Rental Services in Cedar City Utah

Post writing is also a fun, if you know then you can write or

else it is difficult to write.

Приветствую всех! Недавно столкнулся с серьезными сантехническими проблемами. Трубы начали протекать, а я не знал, что делать. Помогла информация из статьи http://175.178.51.79/, где подробно объяснялось похожие случаи. Благодаря этому удалось решить проблему. Теперь все работает, но опыт был нервным! Может, у кого-то были похожие истории?

id=”firstHeading” class=”firstHeading mw-first-heading”>Search results

Help

English

Tools

Tools

move to sidebar hide

Actions

General

I am regular visitor, how are you everybody? This post posted at this web

page is really good.

I was able to find good info from your articles.

My blog post; Dumpster Rental in Cedar City

Hello there, I discovered your website by means of Google at

the same time as searching for a comparable topic, your web site came

up, it appears good. I have bookmarked it in my google bookmarks.

Hi there, just was aware of your blog through Google, and

located that it’s truly informative. I’m going to watch out for brussels.

I will appreciate if you happen to continue this Dumpster Rental Services in Cedar City Utah future.

Numerous other folks will likely be benefited out of your writing.

Cheers!

fantastic issues altogether, you simply won a new reader.

What could you suggest in regards to your put up that you simply

made some days ago? Any certain?

I know this if off topic but I’m looking into starting my own weblog and was wondering what all is needed

to get set up? I’m assuming having a blog like yours would cost

a pretty penny? I’m not very internet savvy

so I’m not 100% positive. Any suggestions or advice

would be greatly appreciated. Kudos

Refresh Renovation Southwest Charlotte

1251 Arrow Pine Ɗr ⅽ121,

Charlotte, NC 28273, United Statеs

+19803517882

Step 5 renovation process proven

We absolutely love your blog and find many of your post’s to be just what I’m looking for.

Does one offer guest writers to write content to

suit your needs? I wouldn’t mind writing a post or elaborating

on many of the subjects you write in relation to here.

Again, awesome weblog!

Also visit my site; Cedar City Dumpster Rental

Great weblog right here! Also your website so much up very fast!

What web host are you the usage of? Can I get your affiliate

link on your host? I desire my website loaded up as quickly as yours lol

Does your site have a contact page? I’m having problems locating it but,

I’d like to shoot you an e-mail. I’ve got some suggestions for your blog you might be interested in hearing.

Either way, great website and I look forward to

seeing it improve over time.

Neat blog! Is your theme custom made or did you download it from somewhere?

A design like yours with a few simple tweeks would

really make my blog jump out. Please let me know where you got your

design. Appreciate it

I am curious to find out what blog platform you’re working with?

I’m having some minor security problems with my latest site and I’d like to find something more safe.

Do you have any suggestions?

Also visit my webpage … ออแกไนซ์จัดงานศพ

https://cont.ws/@hexagon/3132697

This is a fantastic read! I appreciate the insights you shared.

I found it particularly interesting how you discussed the role of technology in our daily lives.

You might also like to explore [Completethyroid](https://buy.info-completethyroid.us/)

I was recommended this website by my cousin. I am not sure whether this put up is written by means of him

as no one else know such unique about my trouble.

You are amazing! Thank you!

always i used to read smaller posts that as well clear their motive, and that is also happening with this post which I am reading at this place.

Hello! I could have sworn I’ve visited your blog before but after looking at a few of the articles I realized it’s new to me.

Nonetheless, I’m definitely pleased I discovered it and

I’ll be bookmarking it and checking back regularly!

You just don’t listen since you don’t like what we’re saying or how we say it. The situation on Line 2 is getting insupportable.

Hello very cool web site!! Guy .. Excellent .. Amazing .. I’ll bookmark your web site and take the feeds also? I’m satisfied to find numerous helpful info here within the post, we want develop extra strategies on this regard, thank you for sharing. . . . . .

Explore the latest in wellness products at buy.neuroxen-usa.com.

If you are looking for health solutions, you’ll find a variety of

options to support your health journey.

Check out their popular items that customers rave about.

Don’t miss out! Visit [buy.neuroxen-usa.com](https://buy.neuroxen-usa.com) for exclusive

offers.

Admiring the dedication you put into your site and

in depth information you offer. It’s good to come across a blog every once

in a while that isn’t the same old rehashed information.

Excellent read! I’ve bookmarked your site and I’m including

your RSS feeds to my Google account.

Najlepsze kasyno online w Polsce

Dolacz do [url=https://billionaire-casino.pl/]billionaire casino[/url]

i ciesz sie najlepszymi grami online, zakladami sportowymi i ekscytujacymi bonusami w Polsce.

Thanks in favor of sharing such a nice thought, piece of writing is nice, thats why i have read it fully

https://khelafat.com/blogs/37180/Melbet-Promo-Code-2026-Bonus-100-to-130

My partner and I stumbled over here by a different web page and thought I might as well check things out.

I like what I see so i am just following you. Look forward to checking out your web page

for a second time.

Здравствуйте, рад вашему вниманию!

Компания XRumer Co предлагает профессиональные услуги СЕО продвижения.

Ваш сайт, как можно отметить, еще только набирает обороты. Чтобы ускорить процесс его роста, готовы предложить услуги по внешней SEO-оптимизации. Продвижение в поисковых системах – наша работа. В ассортименте представлены эффективные СЕО-инструменты для профессионалов. У нас большой опыт и огромное портфолио выполненных проектов – покажем по запросу.

Наша компания предлагает скидку 10% до конца месяца на все услуги.

Предлагаемые услуги:

– Супер трастовые ссылки (нужно абсолютно всем сайтам) – стоимость 1500-5000 руб

– Размещаем 2500 безанкорных ссылок (рекомендовано для любых сайтов) – 3.900 руб

– Качественный прогон по 110 000 сайтам (RU.зона) – 2900 рублей

– Разместим 150 постов в VK про ваш сайт (поможет получить сравнительно дешевую рекламу) – 3.900 р

– Статьи о вашем сайте на 300 форумах (мощнейшая раскрутка вашего сайта) – 29 тыс. рублей

– СуперПостинг – масштабный прогон по 3 000 000 ресурсов (мегамощный прогон для ваших сайтов) – 39 900 руб

– Рассылаем сообщения по сайтам через форму обратной связи – цена по договоренности, в зависимости от объемов.

Обращайтесь с любыми вопросами, мы поможем.

Telegram @eXrumer

https://www.webeffector.ru/

https://XRumer.cc/

I blog often and I seriously thank you for your information. This article has really peaked my interest.

I will take a note of your site and keep checking for

new details about once per week. I opted in for your

RSS feed as well.

id=”firstHeading” class=”firstHeading mw-first-heading”>Search results

Help

English

Tools

Tools

move to sidebar hide

Actions

General

Oi oi, Singapore folks, maths proves ⅼikely tһe most іmportant primary topic, encouraging innovation tһrough issue-resolving for groundbreaking jobs.

Yishun Innova Junior College merges strengths fⲟr digital literacy

ɑnd management quality. Updated facilities promote development аnd long-lasting knowing.

Diverse programs іn media and languages promote imagination аnd citizenship.

Community engagements construct emplathy ɑnd skills.

Trainees emerge аs positive, tech-savvy leaders ready fߋr tһe digital age.

Catholic Junior College provіdes a transformative instructional experience fixated timeless values οf compassion, stability, аnd pursuit of

reality, cultivating ɑ close-knit community ԝheгe trainees feel supported аnd inspired

tⲟ grow both intellectually and spiritually іn a tranquil and inclusive setting.

Тһe college offers detailed scholastic programs іn the liberal arts, sciences, and social sciences, ρrovided by enthusiastic аnd knowledgeable mentors wһߋ employ innovative teaching аpproaches t᧐ trigger

intеrest ɑnd encourage deep, ѕignificant knowing that extends fаr beyond assessments.

An lively array ⲟf cо-curricular activities, consisting ᧐f competitive sports ցroups that promote physical health ɑnd sociability, аs

well aѕ artistic societies tһаt support creative

expreasion tһrough drama and visual arts, allows trainees tߋ explore tһeir interests аnd develop well-rounded characters.

Opportunities fоr signifiсant neighborhood service,

such aѕ partnerships with regional charities ɑnd global humanitarian trips, һelp build compassion, leadership skills, and a genuine dedication tօ making а distinction in the

lives օf ᧐thers. Alumni frߋm Catholic Junior College frequently Ьecome caring and ethical leaders

іn numerous professional fields, geared սp with tһе knowledge, strength, and ethical compass t᧐ contribute positively аnd sustainably tо society.

Ꭰߋn’t tаke lightly lah, pair а excellent Junior College рlus maths superiority іn оrder to ensure superior

А Levels scores ɑs ᴡell ɑѕ effortless chаnges.

Parents, fear thе gap hor, math foundation iѕ essential in Junior

College tօ grasping infoгmation, crucial for current online ѕystem.

Wah lao, no matter іf institution remaіns fancy,

math acts lіke tһe decisive subject іn developing assurance гegarding figures.

Alas, primary maths educates everyday applications ⅼike financial planning,

thuѕ ensure youг youngster grasps that гight starting young.

Oh, math acts ⅼike the base block of primary education, helping kids fоr geometric thinking

to building paths.

Math аt A-levels builds endurance f᧐r marathon study sessions.

Aiyah, primary mathematics educates everyday applications ⅼike oney management, therefore guarantee

yоur youngster ɡets this right starting early.

My website – RVHS JC

https://dochub.com/m/shared-document/hellotownew/B5LgrGvR0m50EoQK9MYq6j/code-promo-linebet-inscription-bonus-jusqu%C3%A0-100-pdf?dt=GMceMr8HVSJsxYC2a61U

Hi there would you mind letting me know which web host you’re working with?

I’ve loaded your blog in 3 completely different browsers and I must say this blog loads a lot faster

then most. Can you recommend a good internet hosting provider at a honest price?

Cheers, I appreciate it!

Wow! In the end I got a blog from where I be able to actually take useful facts regarding my study and knowledge.

Everything is very open with a very clear description of the issues.

It was truly informative. Your website is useful. Thanks

for sharing!

I’m really enjoying the design and layout of your site.

It’s a very easy on the eyes which makes it much more pleasant for me to come here and visit more often. Did you hire out

a developer to create your theme? Fantastic work!

Stop by my blog post MayoKetchup recipe

Today, while I was at work, Read My Article

sister stole my iPad and tested to see if it can survive a thirty foot drop, just so

she can be a youtube sensation. My apple ipad is now broken and

she has 83 views. I know this is totally off topic but I

had to share it with someone!

You should take part in a contest for one of the highest quality sites

on the internet. I am going to recommend this blog!

my webpage Dubai call girls

Почему считаются особенными промокоды букмекерской конторы 1xBet выгодными? Какие знания о кодах, чтобы получить максимум преимуществ от их использования? И, наконец, какие еще интересные моменты в системе бонусов этой конторы, на которые стоит заметить, если вы планируете играть за бонусы. Промокод на 1xBet (актуален в 2026 году, бонус 100%) можно найти по этой ссылке — https://voronezhturbo.ru/images/pages/?1xbet_promokod_pri_registracii_na_segodnya_besplatno.html.

Промокод 1xBet на сегодня актуален, бонус будет зачислен сразу после первого пополнения счета. Временные коды. Букмекерская контора 1xBet часто выступает спонсором при переводе популярных сериалов на русский язык. Рекламные вставки букмекера можно услышать перед началом многих сериалов. Часто в такой рекламе диктуется специальные промокод, дающий возможность беттерам рассчитывать на дополнительный бонус. Максимальный бонус при регистрации составляется 32500 рублей. Воспользоваться промокодом можно только при выполнении ряда условий: Доступно только для беттеров из России, Беларуси, Украины и Казахстана. Возврат игрока – от 18 лет. 1хбет промокод 2025. Промокод 1xBet сегодня найти в интернете не так сложно, достаточно воспользоваться любой поисковой системой. Но обращайте внимание на профессиональность ресурса, откуда будет скопирован промокод. Многие сайты предлагают неактуальные бонусные коды, которые не дадут никакого повышенного депозита после регистрации. На нашем сайте представлен актуальный промокод 1xBet на 2026 год. Вводите промокод, чтобы получить 100% сверху после первого пополнения. Минимальная сумма депозита для использования промокода – 1000 рублей. Ограничивается бонус 1хБет суммой в 32500 рублей.

https://bio.site/dicnahocobt

Бонусы также варьируются по формату. Некоторые из них предлагаются новым клиентам. При регистрации на 1xBet, используйте промокод и получите 100% приветственный бонус до 32500 рублей. Платформа 1xBet предлагает своим клиентам участвовать в спортивных ставках и казино с использованием бонусных средств. Это делает процесс азартнее к игровому процессу и повышает безопасность и комфорт игры. Промокод 2026 года можно найти по этой ссылке — http://www.vlaje.ru/obuv/pages/1xbet_promokod_pri_registracii_na_segodnya_besplatno.html.

Промокод 1xBet при регистрации. Компания 1хБет заинтересована в привлечении новых клиентов, поэтому для новых игроков действует акция в виде бонуса, который равен сумме первого депозита, но не превышает 225 000 рублей. Однако при использовании промокода букмекерская контора увеличит размер приветственного бонуса. Для того чтобы получить повышенную сумму на первый депозит, игроку необходимо выполнить следующие условия: Зайти на сайт букмекера. Выбрать способ регистрации по e-mail. Заполнить поля с личными данными. Ввести промокод в поле слева от кнопки «Зарегистрироваться». Ознакомиться с правилами букмекера. актуальный промокод 1xbet поможет пользователям получить еще больше бонусов от букмекерской конторы. Подробная инструкция по поиску и активации бонусных кодов. Промокод — комбинация из цифр и букв, которая позволяет игроку активировать специальное предложение от букмекера 1хБет. С его помощью пользователь может получить: бонусные средства на депозит; бесплатную ставку; промо-баллы; другие подарки. Сегодня вы сможете найти множество подобных ресурсов, которые регулярно обновляют список актуальных предложений БК.

Thanks, Plenty of advice.

Hi there! This post could not be written any better!

Looking through this post reminds me of my previous roommate!

He constantly kept preaching about this. I will forward this information to him.

Fairly certain he’ll have a good read. I appreciate you for sharing!

Take a look at my webpage; Dubai escort girls

Чем отличаются промокоды букмекерской конторы 1xBet выгодными? Какие знания о кодах, чтобы получить наибольшую пользу от их активации? И, наконец, какие еще интересные моменты в акционной политике этой конторы, на которые стоит учесть, если вы планируете играть за бонусы. Промокод на 1xBet (актуален в 2026 году, бонус 100%) можно найти по этой ссылке — http://kitanoseeds.ru/img/pgs/?1xbet_promokod_pri_registracii_na_segodnya_besplatno.html.

Абсолютно бесплатный промокод 1xBet. На сегодня контора предлагает всем новичкам воспользоваться не только приветственным бонусом, но и получить дополнительные преференции. Эти льготы игрок получает в том случае, если внимательно отнесётся к процедуре регистрации на сайте. промокод на 1хбет 2025. 1xBet – один из самых узнаваемых букмекерских брендов в стране. Следовательно, именно эта компания захватила сердца наибольшего количества игроков. Компания была основана до внесения поправок в закон об азартных играх и оставалась лидером среди букмекерских контор на нашем рынке в правовой реальности. Уже один этот факт должен что-то указывать, так как многие клиенты с удовольствием возвращаются к игре в 1xBet. 1xBet – промокод на 32500р. Свежие промокоды 1xBet Все купоны и скидки букмекера Получи бонус 32500 ? Делай ставки на спорт.

Промо-код 1xBet — пропишите его в графу «Промокод» при открытии счета, депозитируйте свой счет на сумму от 100? и заберите предложением в размере удвоения депозита (до 32 500 RUB). В разделе аккаунта найдите раздел «Бонусные предложения» и активируйте вариант «Активировать промокод». Укажите полученный код в нужное поле. Сохраните изменения и ознакомьтесь с условиями использования.Бонусный код 1xBet 2026 года можно найти по этой ссылке — http://kitanoseeds.ru/img/pgs/?1xbet_promokod_pri_registracii_na_segodnya_besplatno.html.

Wonderful blog you have here but I was curious if

you knew of any community forums that cover the same topics discussed in this article?

I’d really like to be a part of online community where I can get

comments from other knowledgeable people that share the same interest.

If you have any suggestions, please let me know. Bless you!

Актуальный промокод, укажи промокод получи бонус. Получите максимум при регистрации в одной из букмекерских контор. 1xBet предлагает сейчас 32500 рублей всем новым игрокам букмекерской конторы. где найти промокоды 1xbet. Отличительной особенностью букмекерской конторы 1xBet является возможность совершения ставок по промокодам, которые предоставляются бесплатно. В БК 1хБет промокод – это универсальный инструмент при работе с бонусами и акциями. Он может относится как приветственным предложениям для новичков, так и к поощрениям для постоянных клиентов. Подробнее о доступных промокодах лучших букмекерских контор читайте в этом материале. Выделим несколько основных методов, которые позволят получить промокод 1xBet.

Для активации бонусов от букмекера 1xBet, следует соблюсти ряд правил, хотя промокоды позволяют упростить процесс. Размеры бонусов, доступных пользователям через промокоды 1xBet, варьируются, но даже умеренный бонус способен существенно повысить игровой потенциал клиента. Используйте промокод, чтобы получить бонус 100% на первый депозит в текущем 2026 году. Промокод 1xBet доступен по этой ссылке — https://svoyage.ru/doc/pages/1xbet_promokod_pri_registracii_na_segodnya_besplatno.html.

It is truly a great and useful piece of info. I am glad that you

simply shared this useful info with us. Please stay us informed like this.

Thanks for sharing.

Почему считаются особенными промокоды букмекерской конторы 1xBet уникальными? Какие знания о кодах, чтобы взять наибольшую пользу от их применения? И, наконец, какие еще интересные моменты в бонусной программе этой конторы, на которые стоит учесть, если вы планируете использовать бонусы. Промокод на 1xBet (актуален в 2026 году, бонус 100%) можно найти по этой ссылке — https://voronezhturbo.ru/images/pages/?1xbet_promokod_pri_registracii_na_segodnya_besplatno.html.

Промокод при регистрации 1xBet на 32500 рублей. Данный промокод 1хБет нужно ввести при регистрации в соответствующее поле. 1xBet промокод при регистрации можно использовать только 1н раз в рамках одной учетной записи, но вы можете делиться им со своими друзьями. В 1xBet регистрация по номеру телефона является бесплатным и вторым по простоте способом создать личный аккаунт. Данный способ предусматривает наличие мобильного устройства, а также активной сим-карты, чтобы пользователь мог получить сообщение, в котором его будут ждать данные для входа. После того, как данные будут получены, останется ввести логин с паролем в соответствующие поля. Воспользуйся получить промокод для 1xbet, получи бесплатную возможность увеличить свой первый депозит до 32500 рублей в БК 1xBet. Промокоды 1xBet актуальные сегодня. На игровой платформе БК «1xBet» функционирует бонусная программа, способствующая привлечению новых игроков и мотивации делать больше ставок для зарегистрированных пользователей. Бонусная программа содержит множество различных бонусов, которые каппер может активировать при помощи специальных промокодов. 125% бонус от первого депозита на ставки. Получай бонус до 125%, но не превышающий 32500 рублей на ставки от 1xBet. Переходим на сайт букмекера.

It’s awesome designed for me to have a site, which is good in support of my knowledge.

thanks admin

It’s hard to find educated people for this subject,

but you sound like you know what you’re talking about!

Thanks

Feel free to visit my homepage … best real estate agent in Montgomery TX

Hey there just wanted to give you a quick heads up.

The text in your article seem to be running off the screen in Internet explorer.

I’m not sure if this is a formatting issue or something to do with browser compatibility but I thought I’d post to let you know.

The design and style look great though! Hope you get the problem solved soon. Cheers

Look into my homepage: supplements

I got this web page from my pal who shared with me concerning this site and at the

moment this time I am visiting this web site and reading very informative content at this time.

My blog post :: realtor in Montgomery TX

You said it perfectly..

It’s the first identified iteration of UNITAS at a major Marine Corps installation as the exercise is normally held in South America. Being drawn into main conflicts in love is pretty commonplace. December 2 individuals love on an epic scale. Few folks study extra from their mistakes than they do. While exercise can help dispel negative emotions, they usually tend to depend on meditation strategies. They are sure of themselves yet value classes that mates can train them. They know the value of a superb credit rating and want to pay cash. They already know the value of each day exercise. They know that nevertheless sophisticated and demanding their life is, they’ve the option to turn a blind eye to it. While it isn’t straightforward for them to rebound from failure, they’ve the ability to turn their focus to a different important purpose if they must surrender on their primary one. Inhibition, which refers to the flexibility to suppress responses that are inappropriate or irrelevant, has shown marked improvement with increased intensity aerobic activities.

Feel free to visit my webpage … https://git.rikkei.edu.vn/corrinetimbery/corrine2004/-/issues/59

Для получения бонусов от компании 1xBet, необходимо выполнить определённые условия, однако промокоды позволяют сделать это значительно проще. Размеры бонусов, доступных новым клиентам через промокоды 1xBet, не всегда велики, но даже минимальный бонус способен существенно повысить игровой потенциал клиента. Используйте промокод, чтобы получить бонус 100% на первый депозит в 2026 году. Найти промокод вы можете по этой ссылке — https://voronezhturbo.ru/images/pages/?1xbet_promokod_pri_registracii_na_segodnya_besplatno.html.

промокоды 1хбет на игры – комбинация из чисел и букв. Эта комбинация дает возможность игроку получить дополнительные бонусы. К примеру, это может быть: промокод на бесплатную ставку (фрибет); повышение коэффициентов ставок формата «экспресс». Промокод при регистрации применяется именно таким образом. Он позволяет увеличивать размер приветственного бонуса на первый депозит, который выдается самим букмекером 1xBet. Где найти? Вариантов для получения промокода на 1xBet на сегодня существует множество. Но мы предлагаем вводить наш собственный промокод для 1xBet. Это промокод для регистрации, он вводится в поле в регистрационной анкете. Промокод при регистрации на сегодня. Промокоды для БК и Казино — ежедневное обновление. Регистрация на сайте 1xBet бесплатная, но для начала игры и получения доступа к 1xBet промокоду при регистрации 2026, придется внести на игровой счет от 50 рублей. Особенности регистрации. Процедура создания профиля в букмекерской конторе 1xBet максимально упрощена. Для регистрации предусмотрены такие способы: В «1 клик». Чтобы создать учетную запись, нужно выбрать страну проживания и валюту, ознакомиться с пользовательским соглашением и кликнуть на клавишу «Регистрация». С помощью телефона.

It’s very trouble-free to find out any matter on net as compared to textbooks, as I found this post at this web

site.

Hey there, You’ve done an excellent job. I’ll definitely digg it and personally suggest to my friends.

I am sure they will be benefited from this website.

Here is my web site: best realtor in Montgomery TX

You really make it appear so easy together

with your presentation but I find this topic to be actually one thing which I think I

might never understand. It sort of feels too complicated and extremely wide for

me. I’m looking forward in your next publish, I will attempt to

get the cling of it!

My webpage … best realtor in Cincinnati OH

I could not refrain from commenting. Very well written!

Hello there! This is my 1st comment here so I just wanted to give a

quick shout out and tell you I truly enjoy reading your

articles. Can you recommend any other blogs/websites/forums that cover the same subjects?

Thank you!

Definitely believe that which you said. Your favorite reason appeared to be on the

net the easiest thing to be aware of. I say to you, I definitely get irked while people think about worries that they just do not know about.

You managed to hit the nail upon the top and defined out the whole thing without having

side-effects , people can take a signal. Will likely be back to

get more. Thanks

Here is my page: best real estate agent in New Berlin WI

I am no longer certain where you’re getting your info, however

great topic. I must spend some time learning much more or figuring out more.

Thank you for great information I used to be in search of this information for my mission.

Here is my blog post – best real estate agent in Montgomery TX

These are in fact enormous ideas in about blogging.

You have touched some good factors here. Any way keep up wrinting.

Hi there, I enjoy reading all of your article post. I like to write

a little comment to support you.

Feel free to surf to my blog :: 강남쩜오추천

Hi there I am so glad I found your weblog, I really found you by error, while I was looking on Bing for something else,

Anyhow I am here now and would just like to say many thanks for a remarkable post and a all round enjoyable blog (I also love the theme/design), I don’t have time to browse it

all at the minute but I have bookmarked it and also added your RSS feeds,

so when I have time I will be back to read a lot more, Please do keep up the great

b.

I’m now not certain the place you are getting your info, however good topic.

I must spend a while finding out more or working out more.

Thank you for great info I used to be looking for this information for my

mission.

my blog best real estate agent in Chesapeake VA

Do you have a spam problem on this website; I also am a blogger, and I was

wanting to know your situation; we have created some nice procedures

and we are looking to exchange strategies with other folks,

please shoot me an e-mail if interested.

Here is my web page … best realtor in Montgomery TX

Magnificent beat ! I wish to apprentice while you amend your web site,

how could i subscribe for a blog site? The account aided me a acceptable

deal. I had been a little bit acquainted of this your broadcast provided bright

clear concept

Here is my web site … best real estate agent in Montgomery TX

I have to thank you for the efforts you’ve put

in writing this website. I am hoping to see the same high-grade content by you later

on as well. In fact, your creative writing abilities has encouraged me to get my very own blog now 😉

Feel free to visit my web blog: best realtor in New Berlin WI

Excellent post. Keep writing such kind of info on your page.

Im really impressed by your site.

Hi there, You have done an excellent job. I’ll certainly digg it and in my opinion recommend to my friends.

I’m confident they’ll be benefited from this site.

my web page: realtor in Cincinnati OH

Hi to all, it’s truly a fastidious for me to go to see this web site, it contains useful Information.

Here is my website; best real estate agent in Chesapeake VA

Клининговая компания в Санкт-Петербурге: качественная чистка ковров и мягкой мебели с применением современного оборудования и акциями на сайте!Клининг в Санкт-Петербурге

Не ждите, пока грязь и хаос станут катастрофой. Подарите нам шанс возродить вашему пространству чистоту и порядок! Узнайте всё о наших услугах и оставьте заявку на сайте : https://uborka-top24.ru

Ligacor yang biasa juga disebut Gacor Slot adalah bandar online slot

paling gacor. Winrate tinggi, RTP akurat, dan kemenangan pasti dibayarkan.

Piece of writing writing is also a excitement, if you know then you can write or else it is complex

to write.

Also visit my homepage best real estate agent in Chesapeake VA

Amazing! This blog looks just like my old one! It’s

on a completely different topic but it has pretty much

the same page layout and design. Superb choice of colors!

Also visit my web-site; real estate agent Chesapeake VA

An interesting discussion is worth comment. I do believe that you ought to write more

on this subject, it might not be a taboo matter but

typically folks don’t talk about such issues. To the next!

Many thanks!!

Here is my web blog … realtor in Montgomery TX

Hurrah! In the end I got a blog from where I be capable of

really obtain useful information concerning my study

and knowledge.

Also visit my website best realtor in Chesapeake VA

Ну а как сейчас я конечно не знаю как тут… Думаю время покажет, и фараоны может раслабятся:police: либо появится какая нибудь другая лазейка по сбыту..

Онлайн магазин – купить мефедрон, кокаин, бошки

Пришлось высылать чек,региться на ретейле,оформлять заказ.

I’ve been surfing online more than three hours today, yet I never found any interesting article like yours.

It is pretty worth enough for me. In my opinion, if all site owners and bloggers made good content as you did, the internet will be much more useful than ever before.

Hi my loved one! I want to say that this article is awesome, great

written and come with almost all important infos.

I would like to look more posts like this .

Hi there! Do you use Twitter? I’d like to follow you if that would be okay.

I’m absolutely enjoying your blog and look forward to new posts.

Informative article, just what I needed.

Here is my blog – realtor in Chesapeake VA

Wow, fantastic weblog layout! How lengthy have you ever been blogging for?

you made blogging look easy. The full look of your website

is excellent, let alone the content!

Feel free to surf to my blog post realtor in Cincinnati OH

Good answer back in return of this difficulty with solid arguments and telling all concerning

that.

Wow, that’s what I was exploring for, what a information! existing here

at this webpage, thanks admin of this website.

my website :: best real estate agent in Montgomery TX

https://www.milliescentedrocks.com/board/board_topic/2189097/7319962.htm

https://rant.li/dostumortu/utilisez-un-code-promo-1xbet-pour-maximiser-vos-gains-et-debloquer-des-vjjf

What’s up, this weekend is pleasant in favor

of me, because this point in time i am reading this fantastic educational piece of writing here at my house.

Here is my page; realtor in New Berlin WI

Howdy just wanted to give you a quick heads up.

The words in your article seem to be running off the screen in Firefox.

I’m not sure if this is a format issue or something

to do with web browser compatibility but I thought I’d post to let you know.

The layout look great though! Hope you get the problem fixed soon. Many thanks

What’s up it’s me, I am also visiting this website regularly, this web site is in fact fastidious and the

people are genuinely sharing nice thoughts.

I’m impressed, I have to admit. Seldom do I encounter a blog that’s both educative and interesting, and let me tell you, you have hit the nail on the head.

The problem is something which too few people are speaking intelligently about.

Now i’m very happy that I stumbled across this during my hunt for something regarding this.

Review my web-site: realtor in Chesapeake VA

Hi there! This blog post couldn’t be written any better!

Looking through this post reminds me of my previous roommate!

He always kept talking about this. I am going to send

this information to him. Fairly certain he will have a very good read.

I appreciate you for sharing!

Today, while I was at work, my cousin stole my iPad and tested to see if it can survive a

thirty foot drop, just so she can be a youtube sensation. My iPad is now broken and she has 83 views.

I know this is entirely off topic but I had

to share it with someone!

each time i used to read smaller posts that also clear their motive,

and that is also happening with this paragraph which

I am reading at this place.

My website … best real estate agent in Montgomery TX

https://www.southafricanews.net/newsr/15812

Whats up this is kind of of off topic but I was wondering if blogs use WYSIWYG editors or if you have to manually code

with HTML. I’m starting a blog soon but have no coding knowledge

so I wanted to get advice from someone with experience.

Any help would be enormously appreciated!

https://obecretuvka.cz — ссылка на кракен через тор