Description

There are four basic option strategies. Sell a call or buy a call, sell a put or buy a put.

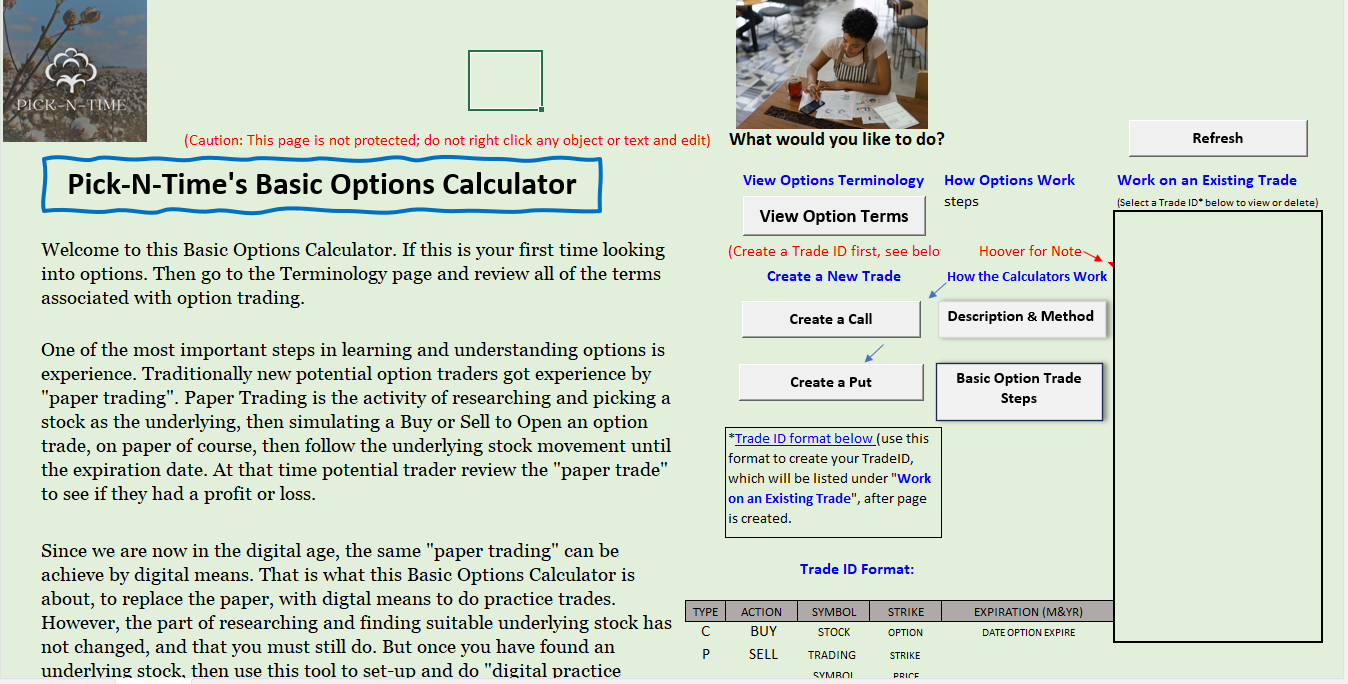

The two calculators incorporate both sides (seller and buyer) of the call, and both sides of the put trade, into one figure for a more complete understanding of the entire trade. You only need to enter data into the gray boxes, then interpret the results.

These calculators are to facilitate you learning options trading by what is called “paper trading”, but in this case it is called “worksheet trading”. Both are practice trades you do, using data of actual stock and options being traded in the markets.

You set up the trade, then, watch the stock price and gauge whether your option is OTM, ATM, or ITM. Your profit or loss is shown, as you change the Closing Stock Price, for if you are either seller or buyer.

Again, after you complete items a-f, these figures will display the status of the option and the profit or loss for both seller and buyer of the option.

Once you enter data correctly, the worksheet calculates and displays what you need to know—the status (OTM, ATM, or ITM) of the option and your profit or loss. Depending on your roll—buyer or seller—you can take various actions to ensure profit or mitigate loss. If the option is OTM, you can wait to see if it will become ITM by expiration or wait to see if it will expire worthless, if this will benefit you. If the option is Near-the-Money or ITM, and you are the seller, but the option is not yet exercised, you may close it early by executing an order opposite to the opening order, if this benefits you.

So, one option provides several ways to make money and several ways to mitigate risk or loss. This is unlike buying stock where your profit is always tied to the upward movement of the stock price, above the purchase price. With options you can make money on a stock that’s going down, sitting still or going up. For basic options this involves either buying or selling puts or calls, but there are more advanced strategies that involve multiple options, sometimes on both the buy and sell side. It can get complicated, but if you learn the basics first, then even the advanced strategies become easy to understand and implement.

See How to Use the Basic Options Calculator.

Click “View Option Terms” to view and read all the option contract terms, so you will know the language of options. This is the most important part of learning option trading.

Click “Create a Call” to simulate Selling or Buying a Call. Before you click the button, first create a Trade ID for your call. See directions and examples. When a call is created, in addition to the new calculator page being inserted into the workbook, the Trade ID is placed in the box, labeled “Work on an Existing Trade”.

When you click a Trade ID inside the box, a pop-up menu: Yes (open), No (Delete) or cancel. Click No only if you wish to delete the page and box entry for the trade. Click Yes to open the Trade ID page and make edits to the trade.

If you click the call or put button and nothing happens, click the Refresh button.

Reviews

There are no reviews yet.