What is Easy Financial Planning?

(Intro and Quick Setup)

Welcome to Easy Financial Planning featuring the time, procedures, and application to assist you in managing your money efficiently.

EFP is an organically created time, routine, or procedure, and an application, driven by the creator’s desire to escape and remain out of poverty, which often leads to crime; and to maintain stable personal financial management always knowing the status of incomes, expenses, assets, and liabilities. The app is designed to make it easy for users to engage with their other current online accounts. This app is not connected to the internet, but users can log into their various accounts, (checking, debts, etc.) and then update their EFP file. Only checking and frequently used debt accounts require daily or weekly updates. Use your checking to update the current EFP Budget. Login and use your loan or credit card account to update the EFP Debt Registers. The ultimate object of the EFP is users’ financial stability, security, and increased net worth, which I hope reflects a successful and prosperous life for users.

The EFP Routine: Time, Procedure & Application

Time – Planning Season (Oct-Dec) Create Pre-Plan & Plan

Procedure – *EFP User Manual (64 pages/dynamic)

Application – Easy Financial Planner (Yearly Plan)

Subjects: Incomes, Expenses, Assets, Liabilities

*Long version user manual undergoing revisions after major

application upgrade. Use short Quick Setup instructions

Note: EFP refers to Easy Financial Planning, the process; also, it refers to the Easy Financial Planner, ‘Your Money GPS’, the application. Take your pick as appropriate.

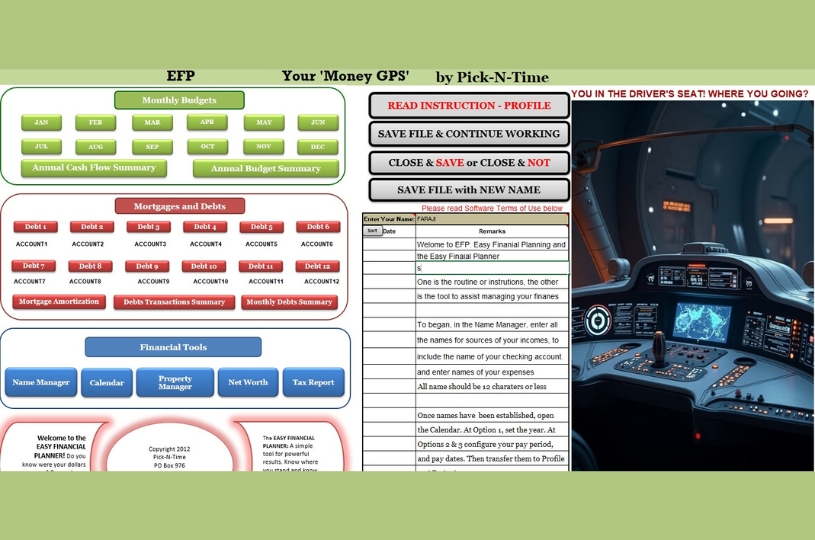

The Financial Planner Application Parts

Flash Screen

Dashboard

Budgets & Reports

Monthly Budgets (12)

Cash Flow Summary

Annual Budget Summary

Mortgage, Debt & Reports

Mortgage Amortization Schedule (2)

Debt Registers (12)

Debt Transaction Summary

Monthly Debt Summary

Financial Tools

Name Manager*

Calendar

Property Manager

Net Worth

Tax Report

Company Information

User Agreement

Command Buttons

INSTRUTIONS: Profile (Pre-Plan)

Name Space

Notes and Reminders

The EFP Procedures

Gather Your Documents and Thoughts, for names, due dates and amounts, for all your actual and potential incomes and expenses.

Create Income, Living & Debt, and Misc. Expense name lists, in the Name Manager; and designate your Checking Account, in the space provided.

Access the Calendar, set the year, and configure (pay period, 1st pay date and amount) your periodic (Monthly Net) incomes. Send it to Budgets and Profile.

Complete the Profile—your Pre-Plan and Big Picture of your annual finances. Enter Other Net Incomes down to Savings, at the end.

Monthly Net Income (entered from Calendar)

Other Net Incomes

Monthly Living Expenses

Other Living Expenses

Monthly Misc. Expenses

Other Misc Expenses

Mortgage Information

Other Debt Expenses

Saving

You then” Send Profile” data, to create your annual plan in:

Budgets

Mortgage Amortization

Debt Registers

January 1st Updates –review and update all account balances including checking, escrow, debts (loans, cards), short- and long-term assets, and the Property Manager.

Implement temporary measures, reverse JAN mortgage principal and escrow amounts. (need balance from Dec 31st previous year)

Compute and record Beginning Net Worth.

Undo temporary mortgage measures.

Determine if you will use Traditional or Perpetual Recording.

Traditional Recording – Begins with only the Name, Pay or Due Date and Budget side amount filled. When a planned transaction, on the budget clears or post to checking, the actual amount that clear checking is recorded on the Actual side of the budget, along with the clear or postdate. The VAR or variance field will show zero or a positive or negative difference, between budget and actual.

Perpetual Recording –Begins with data in all 6 fields: Name, Pay or Due Date, Budget and Actual side amounts, and Clear Date filled, and VAR will display zero. Initially the budget and actual side amounts are the same (the budget amount). When the real actual amount clears checking, record that actual amount as the budget and actual amount, on the budget. This method has the effect of showing, on future budgets, the effect of past and current budget activities (i.e. spending). It gives users the luxury of being able to ‘look ahead’, on the Cash Flow Summary, at their financial situation, to make changes before too late. Also allow you to match (and test amounts) your checking balance, while leaving budget side amounts intact.

If you will use Perpetual recording, take additional setup steps. There are buttons for this.

Start Plan Budget Execution after balances Update, and Begin Net Worth Calculation and Recording

The following are periodic or frequent budgeting tasks user performs, usually determined by level of financial activity by user.

Verify Beginning Checking Balance and record on actual side.

Record Income, Living and Miscellaneous expenses on budget, on actual side, as they clear checking.

Record charges, interest, refunds and payments in the Debt Registers. May also add purchased property to Property Manager.

Record/Edit Mortgage or Escrows in Mortgage Amortization, on Escrow Register.

Updates short- and long-term asset balances on Net Worth.

Flag “Yes” transactions of untaxed income or tax-deductible expenses, on Budgets or in Debt Registers.

Analyze and make decisions about debts using Mortgage Amortization, Debt Registers, Monthly Debt Summary and Debt Transaction Summary.

Access how much, percentage and source of income; and how much, percentage, and payee of expenses using Annual Budget Summary

Maintain and Update home value on Net Worth and Value Adjustment screen.

Update the Property Manager with newly acquired personal property; may also be added while adding a charge transaction in the Debt Registers.

Use color coding of Budget Clear Date: Black—planned, Blue—Due in 5 day or less; Red—Due in 6 day or more; Green—Cleared or posted to Checking.

Check the checkbox at mortgage and debt expense, on Budgets, when transaction clear checking

Select “Yes” in Un-Taxed Income or “Tax Deductible” expense, as required

Sort Transactions as required

Record ‘Actual’ Amounts & Clear Date from Checking

Update saving and investments balances on Net Worth.

Interest Saving –See Mortgage Amortization.

Mortgage Refinance –See Special Instructions

Adjust Home value

Balance Transfers

Reconcile Current Checking Balance

Updates all account balances, compute and record Ending Net Worth, at the end of each month or at the end of the year.

Planning Season—Oct 1 through Dec 31st is designated as time to create your plan for the next year.

With the EFP, you do not start from scratch. You simply save a copy of your current file, with the name of your next year’s file (example: Current: MY2025EFP_ACT; New MY2026EFP_ACT. Continue updating and working on the 2025 active file. But in the 2026 file, the one you will do some clearing and rebuilding, of the budgets and debt register, for 2026. No rebuilding of the mortgage, and other parts, except for updating escrows and asset balances and Property Manager as normal. In the 2026 file, only use and complete the Profile. Do not export data from Profile until Jan 1st of the plan year, after you have transferred the ending balance from (see 16 below) the previous year’s file.

On or near December 31st, in the current year file, update all account balances, escrows, assets, and property.

Compute and record Year End Net Worth.

Prepare for Next Year (see 14., this should start in October)

Duplication current file with the new name (i.e. MY2026EFP)

Continue updating the current year file through December 31st.

Clear & rebuild only Budgets and Debt Registers, from Profile.

Close the current Annual Budget Plan (December 31)

Print Tax Report (Tax Flagged items)

Archive closed budgetary plan.

Transfer Debt Register accounts ending balance from the December chart, in the Monthly Debt Summary, to the Profile Mortgage and Debt area, in the 2026 file. There’s a place for other Debts (non-mortgage) Beginning Balances.

After the Debt Register’s beginning balance updates, review all other data, on the 2026 Profile.

Press Send Profile, to populate all parts of the application, to start your 2026 or next year plan.

After sending, the application will display the January Budget. Use the Next Month button, in the upper right corner, to scroll through to December, observing all budgets populated with income and expense data.

On any Budget, click the Mortgage/Debt hyperlink, in middle Expense summary area or use vertical scroll bar to go down, to the Mortgage and Debts expenses, on the budget, below Living Expenses. Click “Show Amount” to make mortgage or debt payments (recorded in Debt Registers) appear on the actual side of the budget

In the world of accounting, for business, there is the concept and practice of ‘double-entry accounting’ where every transaction involves two or more accounts, where debits and credits are established. The EFP does not deal with ‘double-entry accounting’ or debits and credits, but instead with double-sided budgeting, meaning you have a budget an actual side of the budget, and a variance column. This allows users to maintain their budget in the budget column, but “play with” or “work” their money in the actual column, and to record the actual amount that cleared checking.

Eventually, depending on the recording method used (Traditional or Perpetual), you will have a variance between budget and actual if using Traditional; or you will record the actual amount by checking into both the budget and actual side of the budget. That is called Perpetual Recording, and it shows the effect of current and past expenditures, on both sides of the budget, on future budgets, to alert users to future budget deficits. When a monthly budget is closed, both sides—budget and actual match, and are equally populated with the actual amount of each transaction. So, the effect of everything done before, or currently, is reflected in your future budgets. This helps keep you within your spending plan.

Once data is exported from the Profile, all subsequent edits (see 10., above) are done on the Budgets, in the Debt Registers, Mortgage Amortizations, Escrow Registers, Name Manager, Property Manager, and Net Worth and Valuation Adjustments (Real Estate) report. The exception to this is the editing of the Beginning balances of Debt Register accounts, as seen on the January Chart, in the Monthly Debt Summary. Change or edit these on the Profile, in the Debt section.

Thanks

FaraJi AH GoreDenna